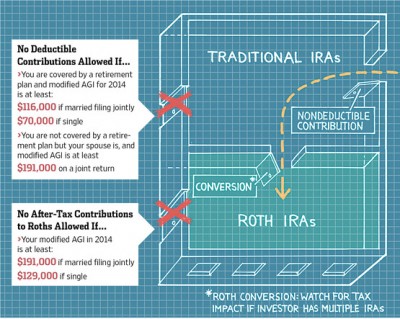

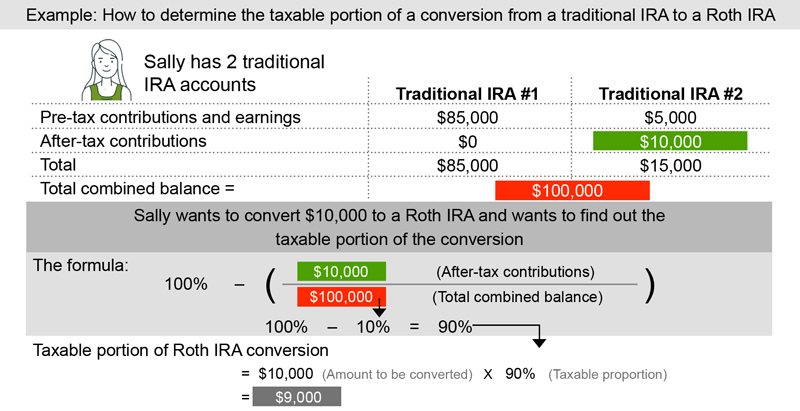

Since the income limits on roth conversions were removed in 2010 higher income individuals who are not eligible to make a roth ira contribution have been able to make an indirect backdoor roth contribution instead by simply contributing to a non deductible ira which can always be done regardless of income and converting it shortly thereafter.

Backdoor roth ira conversion rules.

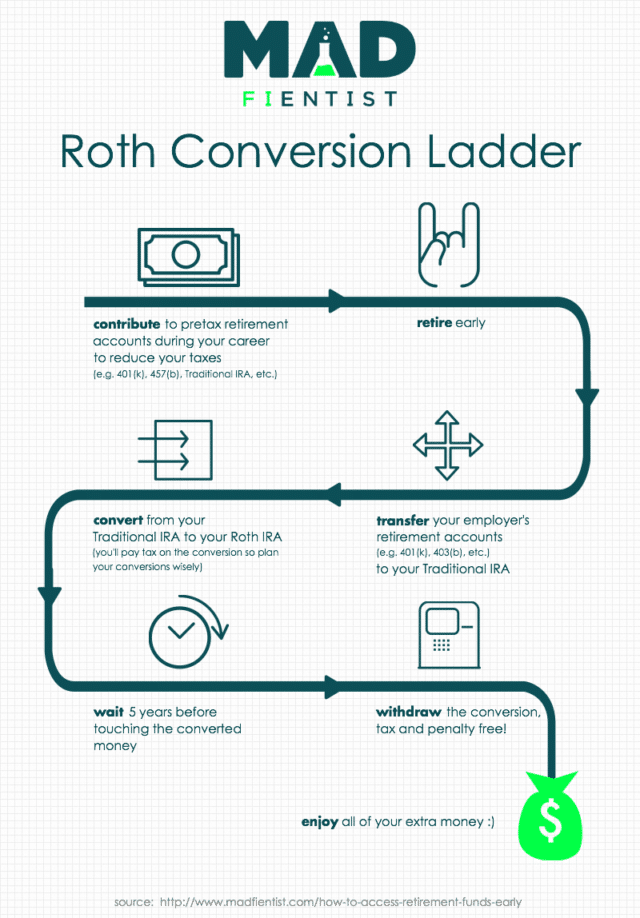

Rather they are usually traditional ira accounts or 401 k s which have been converted to roth iras.

If you do have these types of accounts you re not hosed but you need to have a strategy to move that money elsewhere or you can forget about the backdoor roth.

Income limits are attached to the ability to contribute to a roth ira each year.

You can convert your traditional ira to a roth ira by.

If you do hold tax deferred ira dollars you ll be subject to taxes when making your conversion per the pro rata rule.

A backdoor roth ira is a legal way to get.

Then move the money into a roth ira using a roth conversion.

Since traditional iras don t have an income limit for contributions and traditional iras can be converted into roth iras individuals can fund a traditional ira with nondeductible contributions.

First place your contribution in a traditional ira which has no income limits.

Backdoor roth iras are not a special type of account.

The backdoor roth ira is one of those options but there are state and federal tax pitfalls to converting money from a traditional ira or a qualified retirement account such as a 401 k to a.

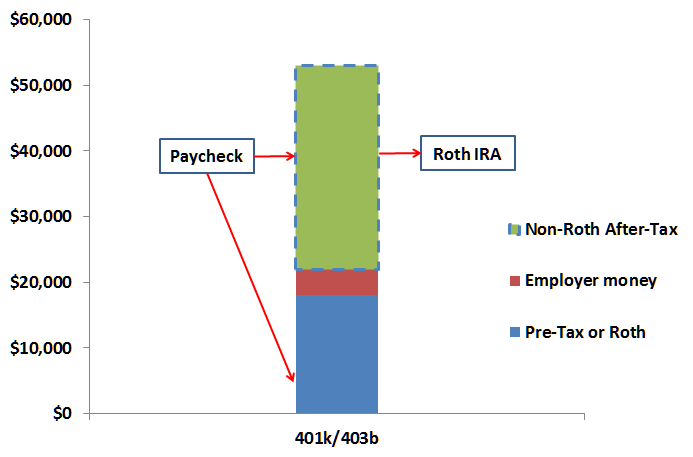

Any funds in a qrp that are eligible to be rolled over can be converted to a roth ira.

A conversion can get you into a roth ira even if your income is too high the conversion would be part of a 2 step process often referred to as a backdoor strategy.

While the most common roth ira conversion is one from a traditional ira you can convert other accounts to a roth ira.